Employers offer financial education to help workers manage money

Edwenna Ervin, regarded as “Eddie” to family members, close friends and colleagues, was dwelling paycheck to paycheck when she initial started out functioning as a buyer assistance agent for Verizon in 2016. She was battling to arrive up with plenty of revenue to pay down financial debt.

“No make a difference how massive your paycheck is, if you really don’t know how to help you save, you will not know how to utilize it to your bills or just take care of it, it could as perfectly be a compact paycheck,” Ervin mentioned.

1 of her supervisors at the time told her about the firm’s staff support program, or EAP, a no cost office reward that delivers help for employees struggling with monetary troubles and other issues. The application presented assets and counseling to support Ervin with budgeting, managing revenue and paying out off debt.

“It aided me do the job out a way to regulate it far better, so that I had a harmony between what I wanted to fork out and what I required to stay,” explained Ervin, who is now a senior engineer project supervisor at Verizon doing work remotely from her South Carolina house.

Workplace positive aspects enable take care of day by day funds

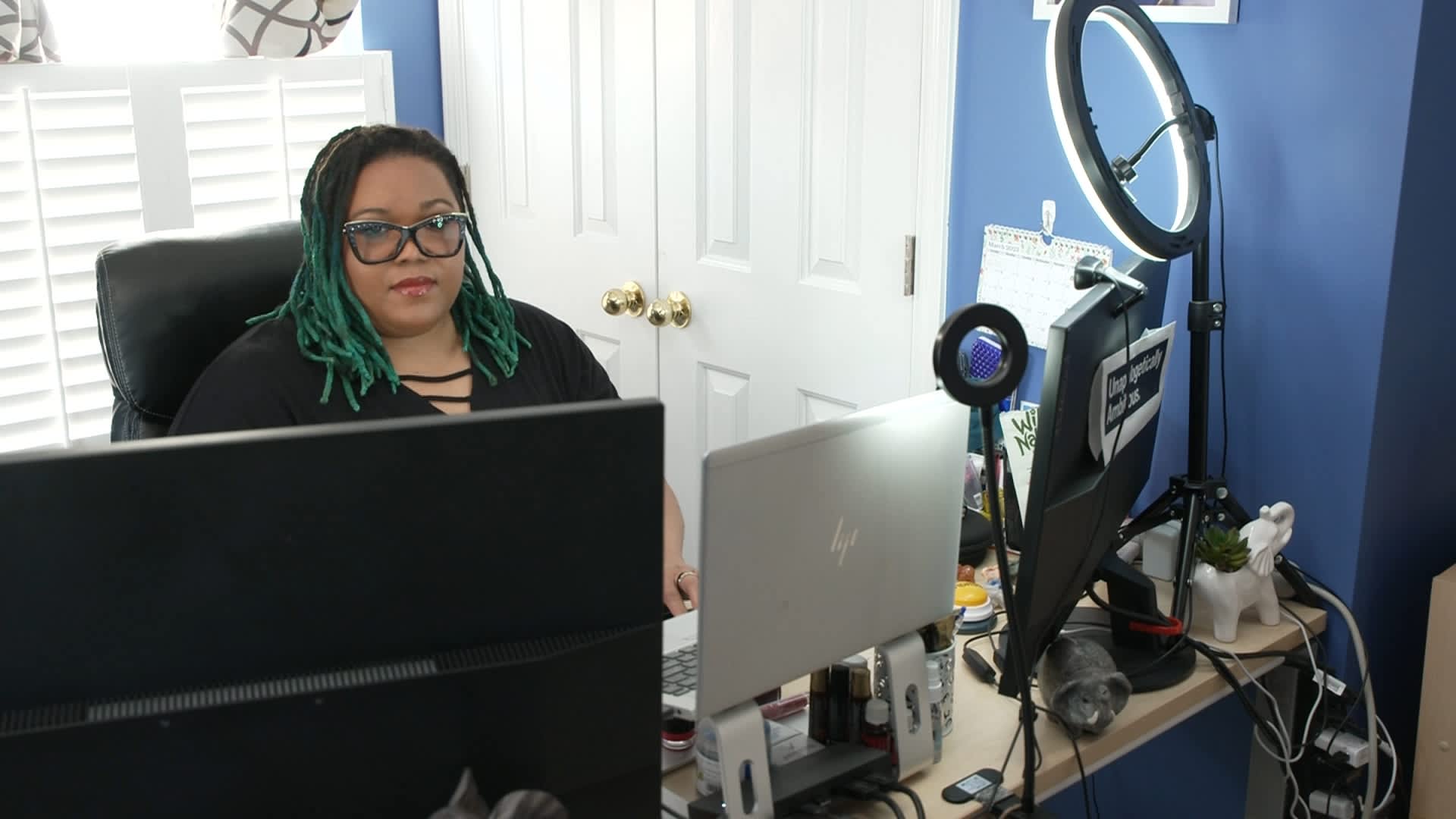

Edwenna Ervin is effective in her home workplace.

Much less than a quarter, 21{9f99fe44fce1aa3c813d0a0ce4da2fbea8a5a58e9d85c4a2927dd8140cb676b5}, of employers at this time offer non-retirement monetary rewards, according to a 2022 survey by the Society for Human Source Administration. Corporations report that some of the most significant added benefits to firms consist of those connected to health and fitness, retirement financial savings and arranging, and flexible perform, but non-retirement financial gains usually are not considerably down the listing.

A lot of businesses say they are listening to their workers’ requirements.

“The regular emphasis on monetary wellness, which was almost completely about the 401(k) strategy, it is just not sufficient any longer. Our staff are inquiring for enable with all features of their monetary existence,” reported Kevin Cammarata, vice president of gains at Verizon.

“Though you can pay out personnel much more, that isn’t going to imply they’re going to be fiscally safe,” he claimed. “So increasingly, we as companies have to support personnel do their employment, get paid their wages, but also regulate their wages as perfectly.”

Analysis demonstrates that workforce who have had access to monetary instruction and applications, which includes films, classes and coaching, are extra probably to increase personal savings, experience significantly less overwhelmed by personal debt and make progress towards their financial objectives.

Not ‘a fantastic solution’

Nevertheless, monetary literacy advocate Laura Levine says supplying these sources as a result of the workplace is “not the excellent option” and may possibly not arrive at the most vulnerable employees.

“If it’s an ‘opt in’ [benefit], you occasionally skip the folks who have to have this, mainly because they are anxious that if they get the program, or consider gain of what is actually getting provided, that people will decide them for what they you should not know,” reported Levine, president and CEO of the JumpStart Coalition, a Washington, D.C.-based nonprofit concentrated on economical education for learners.

“By the time you are a working grownup, you know, it can be a very little bit late, you could have presently gone down a path which is heading to be tricky to correct,” she reported.

Employees at Verizon headquarters in Basking Ridge, NJ.

Tara McCurrie, CNBC

Educating workers and households about funds

Ervin stated she needs she experienced learned much more about budgeting and financial arranging a great deal earlier — for herself and her family members.

“We struggled a very long time unnecessarily, simply because we didn’t have the know-how or equipment or abilities to do what we would have to have to do to make points improved,” she reported.

Immediately after going by means of the EAP, Ervin elevated her credit score score. She acquired a residence and a new car. And, now she helps her mom and dad with their funds.

Sign up for “Women & Prosperity,” a CNBC Your Funds occasion, on April 11 as we discover methods females can enhance their income, preserve for the foreseeable future and make the most out of current chances. Sign up at cnbcevents.com for this virtual function.

Indicator UP: Dollars 101 is an 8-7 days discovering class to fiscal flexibility, delivered weekly to your inbox. For the Spanish variation, Dinero 101, simply click below.