Indiana student’s nonprofit wants to fight economic inequalities

Most freshmen are just trying to get their feet below them when getting into superior university. But then there are some like Isaac Hertenstein, who entered substantial university seeking to tackle issues like economic inequality and monetary literacy in youth.

That is what led Hertenstein, now a junior at Greencastle Large School, to start out College students Training Finance, a nonprofit that aims to use mostly substantial faculty-aged students to educate essential economical literacy and personalized finance techniques to K-8 students in their very own group.

The two of Hertenstein’s mom and dad are educators and combining that background with his passion for economics, it would seem that it was a organic route for him to start out Learners Training Finance. But one particular of the key causes he started out the group was observing the economic inequalities in his have group.

“Seeing this seriously impressed me to attempt and educate money literacy, precisely to college students in grades K-8, in purchase to plant seeds for long term economic studying with the hopes of combating these economic inequalities and economic complications,” Hertenstein stated. “And if you had been to talk to kids in my high college, they genuinely want to learn about this fiscal education and learning.”

Supporting Lecturers:Meet up with the Indiana math teacher who won a $25,000 Milken Educator Award

Taking a particular finance system is not expected for Indiana students to graduate higher faculty and at the time Hertenstein saw that require in his fellow classmates, he needed to make them the ones educating the lessons.

Hertenstein explained it indicates that additional superior schoolers are being familiar with essential private finance ideas ahead of they go away superior school, though also serving to pass on that information to young generations.

“Having that variety of job design aspect,” Hertenstein claimed, “and the mentorship type of model for instructing can increase our impact on these little ones.”

How it received started off

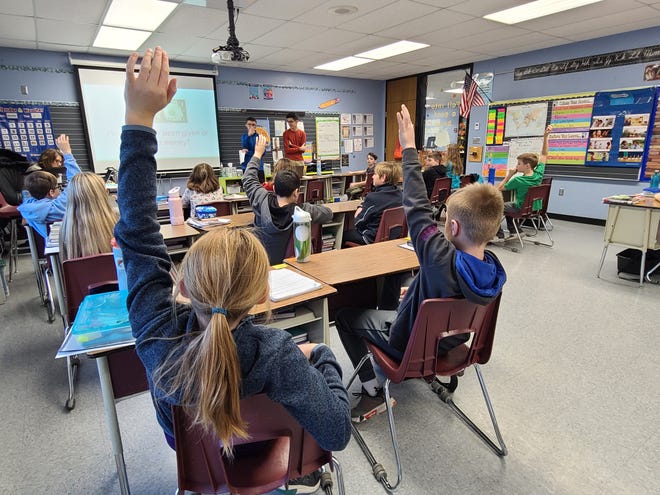

Hertenstein, alongside with 40 of his fellow economics classmates, recently taught some personalized finance classes to fourth and fifth-graders at the Tzouanakis Intermediate Faculty in Greencastle, where by they discovered about factors like offer and desire, price savings, compound fascination and investing.

The curriculum the high schoolers instruct is a little something Hertenstein produced himself, following consulting many community associates and a few of professors from universities in Indiana.

Phil Schuman, the govt director of economical wellness and education at Indiana University, was just one of those consulting professors and served coach Hertenstein on how to make lessons that are approachable and attainable, primarily for young college students who may not know something about finance principles.

“You have to achieve them the place they’re at,” Schuman explained. “If it is not relevant to them at that place, then they’re less very likely to pay notice and they’re fewer possible to retain that information.”

The curriculum is free and offered on-line for everyone to down load and Hertenstein encourages people today to modify it for the requirements that would very best serve their group.

Legislative priorities:Indiana instructor unions contact for a lot less ‘culture war’ expenses, additional guidance in 2023 session

Shuman thinks Hertenstein has finished a great job at employing the data he’s collected about private finance and admires him for tackling these kinds of a major problem as financial inequalities. He also observed that a great deal bigger methods and concerns would need to have to be addressed first in get to truly make an impact on the challenge, but thinks Hertenstein’s work is a great commencing issue.

“I think what the most significant issue that [Hertenstein] is undertaking, is he is finding individuals to interact in discussions about finances,” Schuman said. “Our modern society treats funds as a taboo topic, but what he is carrying out is obtaining men and women to engage in discussion and receiving people to understand by themselves as it relates to finance.”

Professionals have proven that growing fiscal literacy earlier on in a person’s lifestyle can support decrease money inequalities, and investigation revealed by the Nationwide Bureau of Economic Research showed that a single-3rd of U.S. prosperity inequalities could be accounted for by dissimilarities in monetary knowledge.

Impacts on younger and older pupils

Hertenstein’s economics instructor, Kara Jedele, mentioned the effects on the fourth and fifth-quality students was viewed as soon as her learners remaining teaching for the first time.

“’We want them to remain for a longer time,’ is what the fourth graders retained telling me,” Jedele explained.

She also sees the affect the training is owning on her have college students and said that it is assisted them have an understanding of the finance ideas even much better and has boosted their personal self-self esteem.

Indiana college students are demanded to acquire a single credit of economics ahead of graduating, but Jedele mentioned if she had it her way, she would make personalized finance the required program.

“Every day we speak about a thing that is relevant to them,” Jedele stated. “We just completed up a device on paying for college or university and we experienced some pupils who didn’t even know what the FAFSA was.”

Hertenstein’s perform with Learners Teaching Finance has also been getting nationwide and regional recognition.

Hertenstein recently received the Serve Indiana’s 2022 Youth Volunteerism Award and was also selected before this year to acquire a $15,000 reward from the Prudential Financials’ Emerging Visionaries plan.

Hertenstein claimed he will use that cash, and other funds raised by grants and fundraising, to aid with giving assets to other chapters like the books incorporated in the curriculum that aid instruct initial graders.

Long run designs for Pupils Educating Finance

Hertenstein also has massive ambitions for Pupils Educating Finance and has previously worked on having his software into other states. He reported as of now there are chapters in 12 other states, and Hertenstein on your own has taught all around 550 students just in his neighborhood.

Hertenstein mentioned he presently doesn’t know of any chapters beginning in Indianapolis but is performing on reaching out to schooling leaders in the town to hopefully begin 1 soon.

Retain up with school news:Indicator up for Review Corridor, IndyStar’s weekly instruction newsletter.

He also needs to affect adjust on an even bigger scale and wants to support advocate for a new legislation to be made in Indiana that would demand superior schoolers to choose a individual finance study course to graduate. Hertenstein states that is continue to in the beginning stages of taking place but wishes to maintain pushing for a lot more money literacy to be taught in educational facilities.

As he prepares to head to higher education shortly, Hertenstein says he however ideas to continue to keep training classes even when he’s in school.

Jedele mentioned she ideas to perform with Hertenstein on how to incorporate Learners Teaching Finance into the school’s business and entrepreneurship club and hopes to just take higher schoolers to teach into the grade educational facilities on a far more frequent basis.

“We would like to get to a point wherever we are ready to train a lesson to just about every one child in Putnam County or at least in Greencastle Local community Schools,” Jedele mentioned. “And when it catches on, it’s a fantastic product that we hope other educational facilities in Indiana will capture on to as nicely.”

To discover a lot more about how to get started your very own chapter of Learners Teaching finance, check out www.studentsteachingfinance.org.

Make contact with IndyStar reporter Caroline Beck at 317-618-5807 or [email protected]. Abide by her on Twitter: @CarolineB_Indy.

Caroline is also a Report for The usa corps member with the GroundTruth Venture, an independent, nonpartisan, nonprofit information corporation dedicated to supporting the up coming generation of journalists in the U.S. and all around the planet.

Report for America, funded by both of those private and community donors, addresses up to 50{9f99fe44fce1aa3c813d0a0ce4da2fbea8a5a58e9d85c4a2927dd8140cb676b5} of a reporter’s income. It’s up to IndyStar to obtain the other 50 {9f99fe44fce1aa3c813d0a0ce4da2fbea8a5a58e9d85c4a2927dd8140cb676b5}, through community group donors, benefactors, grants or other fundraising actions.

If you would like to make a personal, tax-deductible contribution to her posture, you can make a just one-time donation on the web or a recurring every month donation by using IndyStar.com/RFA.

You can also donate by test, payable to “The GroundTruth Venture.” Deliver it to Report for The usa IndyStar Marketing campaign, c/o The GroundTruth Job, Lockbox Companies, 9450 SW Gemini Dr, PMB 46837, Beaverton, Oregon, 97008-7105. Make sure you set IndyStar/Report for The us in the check out memo line.

.