On Your Side: Teaching financial literacy in high school

A new research by Ramsey Alternatives found that 88 p.c of American grownups do not feel large college organized them to deal with funds in the genuine globe. One nearby nonprofit is doing the job to improve that.

Just about just one in five young older people among 18 and 24 a long time of age have debt in collections. And authorities say lots of of them are in that predicament mainly because they only do not realize how credit rating is effective.

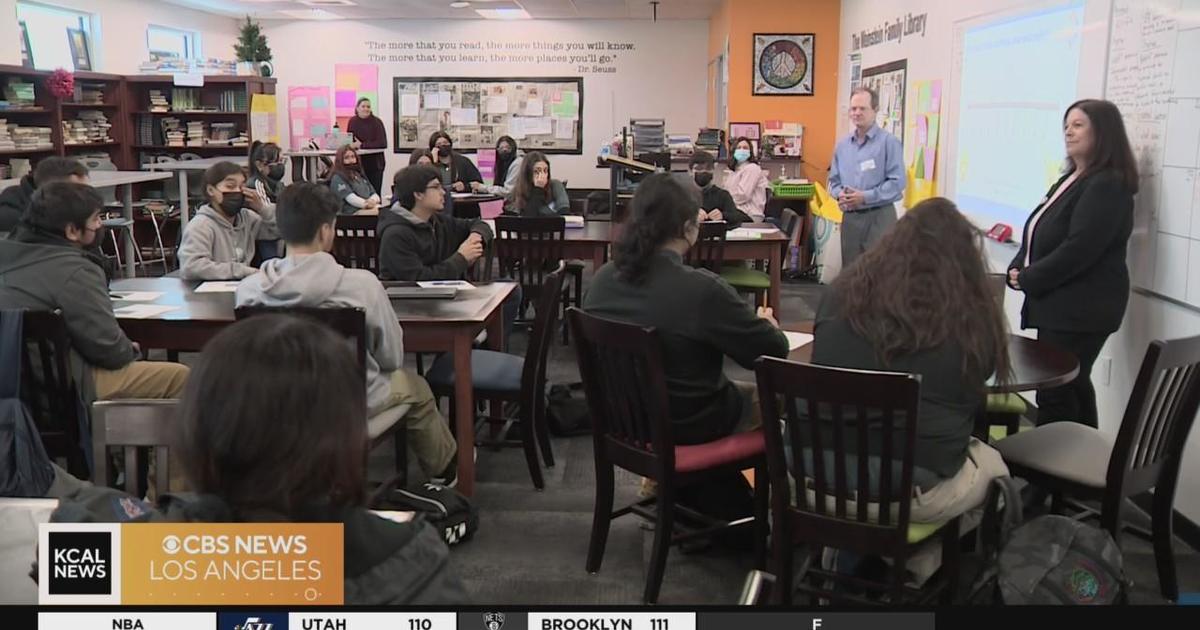

Volunteer bankruptcy and restructuring lawyers are striving to adjust that at the superior faculty degree. They’re with a non-earnings group termed Treatment: Credit score Abuse Resistance Education and learning.

“We have all found firsthand what takes place when youthful grownups do not discover monetary literacy. They appear to our courts, they occur to our workplaces, they are our consumers,” stated individual bankruptcy lawyer Jeff Pomerantz.

The neighborhood chapter of Treatment shaped in 2018 and has considering that arrived at about 5,500 pupils.

We viewed their presentation at Alliance Maritime College, exactly where pupils are taught about credit score and debit card use, interest prices and late service fees.

“Obtaining an Iphone, if you acquired it and made a minimum amount payment, my most loved line is you’ll be paying out off the Apple iphone 14 when the Iphone 19 arrives out,” reported Pomerantz.

Learners are also taught how to get and preserve superior credit score, explaining credit as a thing akin to an grownup report card.

A just-released review by Ramsey Solutions discovered that only 17 {9f99fe44fce1aa3c813d0a0ce4da2fbea8a5a58e9d85c4a2927dd8140cb676b5} of American older people polled took a personalized finance class in university. And 72 p.c responded that they would be further forward with their cash experienced they taken a person.

“Which is why I also imagine it’s quite significant that mother and father are additional comfy with chatting about taking care of their cash with their young children,” stated Sona Melikyan, a higher faculty junior. “For the reason that inevitably one particular working day they are going to increase up and they are not going to know something.”

We questioned pupils what misconceptions they had about funds.

“I definitely underestimated fees. I failed to believe there ended up so numerous and that they could have these a massive influence,” claimed Melikyan.

“I did not genuinely comprehend just how significantly-achieving your credit score score is,” stated significant faculty junior Lucas Balbuena. “I failed to recognize that even landlords and businesses would appear at your credit rating.”

There is a invoice that was introduced before this yr in Sacramento that would make it mandatory for California community significant colleges to give a money literacy study course by the 2025-26 university year. If it passes, it would also make it a graduation requirement by 2029.

To ask for a presentation or to volunteer, pay a visit to Treatment Los Angeles or make contact with Jeff Pomerantz at [email protected].