Retirable secures $6M to plan retirement for those without millions in savings • TechCrunch

Retirement options are usually built by people today who truly feel they can actually quit their jobs at a certain age and have more than enough revenue to retain their way of living. But what about all those who never?

A number of fintech startups are tackling this challenge, which includes Retirable, which thinks that retirement arranging should be just as uncomplicated to get even if you won’t ever have millions of pounds set aside. The New York-primarily based startup describes alone as a “first-of-its-form holistic” tactic to retirement scheduling.

Building off of a 2019 study by TransAmerica Center that located only a single in 5 workers has a written retirement method, the firm provides very similar choices to other retirement preparing corporations: a focused advisor and merchandise and companies for investing, planning and investing.

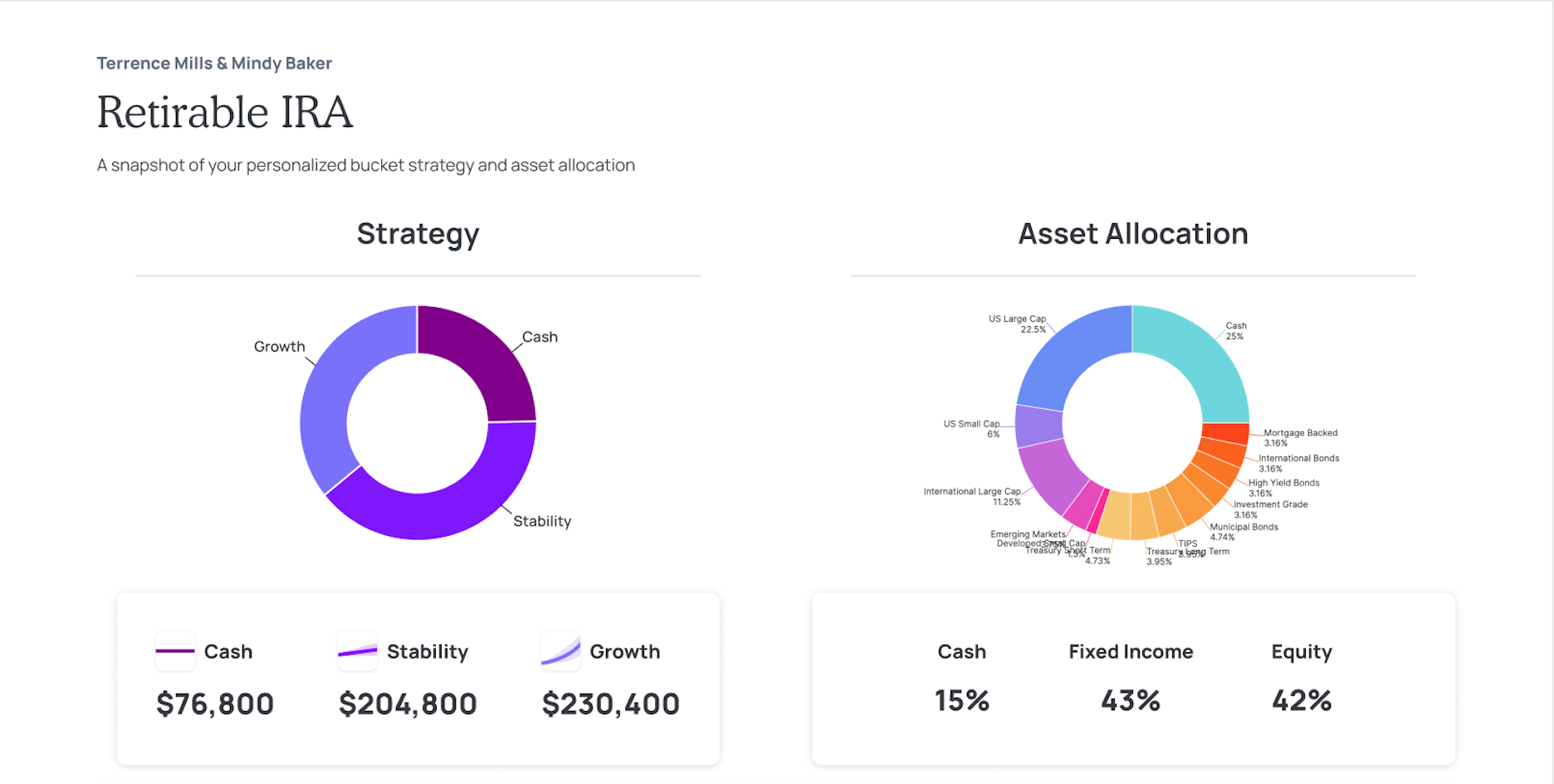

But which is in which co-founder and CEO Tyler Conclusion says the similarities stop: not only is it targeted on reduced net-worth people, but it also went all in on retirement “decumulation.” It does this by allocating an individual’s belongings into a few buckets: income, steadiness and development. The customer can see what their income is in authentic time and how substantially is protected to commit every thirty day period. It also applies this exact same logic to investments and is doing the job on a debit card that gives money again into price savings.

The business delivers a absolutely free session to Americans aged 50 years and more mature and prices its support at .75{9f99fe44fce1aa3c813d0a0ce4da2fbea8a5a58e9d85c4a2927dd8140cb676b5} on the very first $500,000 of managed property, and nothing at all soon after that. Stop stated that interprets into about 63 cents for each $1,000 managed, which is decrease than similar advisory providers.

Retirable’s asset allocation dashboard. Image Credits: Retirable

“Big players may well provide call centers to have anyone support you with your account, but we’re the only ones offering you a committed advisor that you can belief that will perform with you on your program that is fiduciary, that means no commissions,” Stop instructed TechCrunch. “You see a good deal of folks start with a mission comparable to ours of encouraging all people, but when folks are incentivized to promote, they typically drift in the way of larger internet truly worth.”

Stop founded the company in 2019 with Ian Yamey and Brian Ramirez, and jointly with their 15 workforce, Retirable designed proprietary technologies that has made a lot more than 50,000 retirement programs.

A thirty day period ago, the organization introduced its expenditure management and paycheck goods and has begun matching its customers with planners. Retirable also grew its profits by about 25{9f99fe44fce1aa3c813d0a0ce4da2fbea8a5a58e9d85c4a2927dd8140cb676b5} thirty day period above month.

These days, the company introduced $6 million in supplemental enterprise-backed seed funding to give the organization $10.7 million in whole investment decision to date. The spherical was led by Major and involved Vestigo Ventures, Diagram, Portage and Primetime.

End said the new funding will be made use of to speed up the advancement of the debit card, keep on to mature the advisor group and incorporate new distribution channels, for case in point, functioning with Medicare brokers, tax planners and estate planners.

“One of the fascinating factors about this demographic is that some individuals expend way also considerably way also early,” he added. “When you’re genuinely lively in retirement, spending fluctuates as you age. What this debit card does is give equally the consumer and the advisor perception into investing amounts and the place the funds is staying put in. Then from that, we can supply reductions on major of price savings. It’s a first-of-its-variety of product.”